I grew up in a middle class home and part of that upbringing looked down on discussing money and how to grow it. It was good to have it but never good manners to talk openly about it.

That led to some very poor money management in my 20’s and 30’s. Infact, it is only now in my 40’s that I am learning how to unlearn those beliefs. This means starting from scratch.

In today’s economy, it’s more important than ever to budget for pretty much everything.

This post is all about 9 Efficient ways of Creating a Family Budget That Shows Results.

A well-planned budget helps families allocate funds properly, minimise their debt and save for the future. This post provides a step-by-step approach to creating a family budget that shows results.

Don’t miss out the BONUS TIPS for Budgeting in High-Inflation Times at the end of this post.

Step 1: Assess Your Financial Situation

Before creating a budget, collect all information about your family’s financial status. This includes income, expenses, debt, savings and investments.

- For income list all sources of income, such as salaries, rental income, side gigs, or any governmental aid or benefits.

- For expenses, categorise fixed expenses such as rent/mortgage, insurance, loan payments etc, and variable expenses such as groceries, entertainment, transportation etc.

- For debt, identify any outstanding debts, including credit card balances, loans, and medical bills.

- For savings and investments, assess the state of your emergency fund, retirement accounts, and other investments.

Step 2: Set Financial Goals

Once you have a clear financial outlook, set short-term and long-term goals. These may include: Paying off debt, building an emergency fund, saving for a family vacation, funding children’s education, investing for retirement etc.

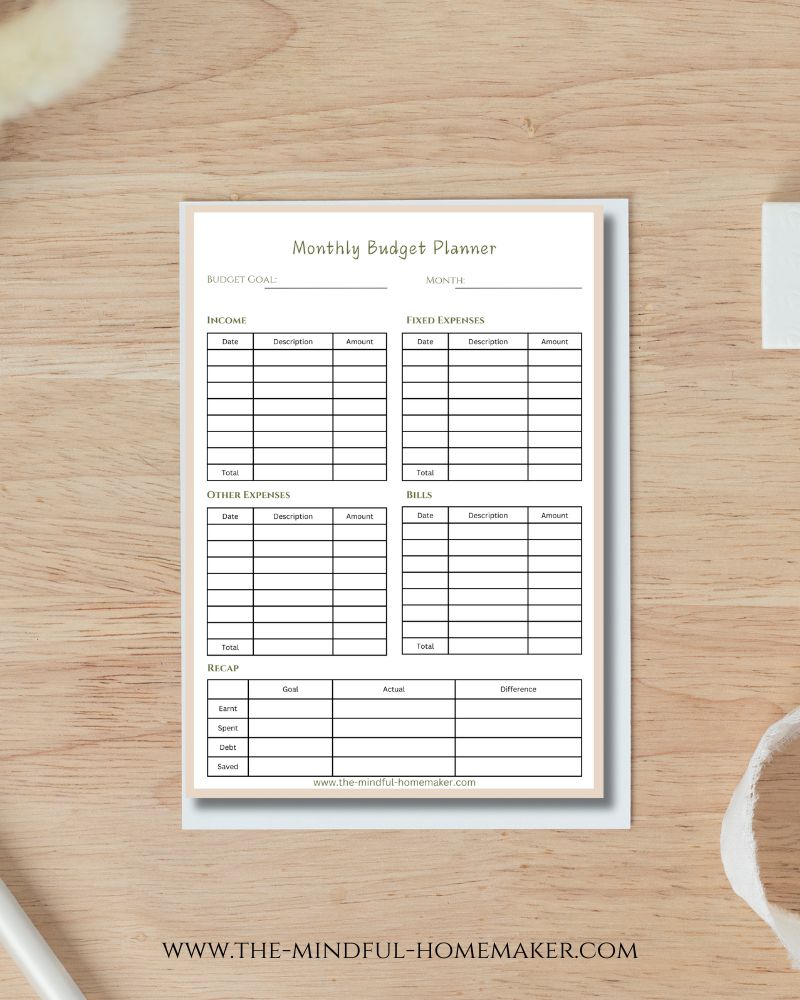

Step 3: Create a Budget

Now that you have financial goals, create a budget that makes sure that your income covers expenses while leaving breathing room for savings. Use a simple budgeting framework, such as the 50/30/20 rule. This would look something like this:

- 50% for Needs: Essential expenses like rent, utilities, groceries, transportation, and insurance.

- 30% for Wants: Non-essential spending, such as dining out, subscriptions, and entertainment.

- 20% for Savings and Debt Repayment: Emergency fund contributions, retirement savings, and loan repayments.

Step 4: Track and Adjust Spending

A budget is effective only if it’s consistently followed. Use budgeting apps, spreadsheets or notebooks to track spending and compare it to your planned budget. Cut back where necessary.

Step 5: Reduce Expenses and Find Ways to Save

The best way to know where you’re spending is to go through a couple of month’s worth of bills. Before starting this procees, I would suggest collecting bills for everything you spend on for atleast two months.

Identify the areas to cut back on unnecessary spending. This can free up money for savings and investments. This can be done in a few ways.

- Meal Planning: Reduce food waste and avoid impulse grocery purchases.

- Shop Smart: Buy in bulk, use coupons, and compare prices.

- Entertainment Alternatives: Opt for free or low-cost activities such as family game nights or community events.

- Utility Conservation: Reduce electricity and water usage.

Step 6: Build an Emergency Fund

An emergency fund acts as a financial safety net for unexpected expenses, such as medical bills or car repairs. Try for at least 3-6 month’s worth of living expenses in a dedicated savings account.

Step 7: Pay Off your Debt Strategically

If your family has debt, prioritising repayment can be done either by the Debt Snowball Method (Paying off the smallest debts first) OR the Debt Avalanche Method (Focus on paying debts with the highest interest rates first).

Step 8: Plan for the Future

Financial planning goes far beyong your day-to-day budgeting. Consider your long-term financial security, for E.g:

- Start a College Savings Plan

- Get a head start on your retirement planning. Don’t wait until you’re in your 50’s or 60’s to plan.

- Keep all your insurances up to date. Ensure adequate life, health, and property insurance coverage.

Step 9: Communicate and Involve the Whole Family

Budgeting should be a family effort. Hold regular budget meetings to discuss finances, track progress, and make changes accordingly. Creating a family budget that works requires teamwork, discipline, and dedication.

In times of high inflation, being adaptable and mindful of spending becomes even more important. Start today, and watch your family’s financial future thrive!

BONUS TIPS for Budgeting in High-Inflation Times:

- Adjust Spending Priorities: Focus on necessities and cut back on unnecessary expenses.

- Buy in Bulk and Store Non-Perishables: Buy staple goods in bulk before prices rise further.

- Use Cashback and Reward Programs: Take advantage of loyalty programs and credit card rewards to maximise savings.

- Negotiate Bills and Services: Contact service providers to negotiate lower rates or switch to more affordable plans.

- Alternative Income Sources: Consider part-time gigs, freelancing, or monetizing hobbies to supplement income.

For Free Printable Budgeting planners click here or follow the link below.

If you enjoyed reading this post, don’t forget to check out more budgeting posts here.

Follow us on our Instagram and Pinterest for more content.

Leave a Reply